The Nonprofit Show is the nation’s daily live video broadcast for the business of nonprofits — where nonprofit leaders, teams, and changemakers gain practical strategies to strengthen operations, improve performance, and sustain impact.

Each weekday, our Co-hosts and expert guests tackle the most current topics in fundraising, management, marketing, staffing, and technology — all designed to help you run smarter, lead stronger, and deliver on your mission with confidence.

Join our community of nonprofit professionals and explore the real tools and insights you need to build a high-performing organization.

Watch Live. Learn Daily. Lead Better!

Monday thru Friday

Sign-up for Show Reminders!

Meet Our Co-hosts!

Made Possible By Our Generous Education Partners Who Support And Believe In The Work You Do

OUR LEARNING LIBRARY WITH MORE THAN 1,000 EPISODES!

MEET SOME OF OUR FEATURED GUESTS AND EXPERTS

AI isn’t a “someday” conversation for nonprofits anymore it’s a right-now operational decision with governance, risk, and staff behavior at the center. Joshua Peskay, Co-Founder of Meet the Moment, joined Julia C. Patrick to talk about the practical reality nonprofits are facing: AI adoption is already happening inside your organization whether leadership has planned for it or not.

Joshua frames the moment with a clear warning and a workable path forward. Too many nonprofits, he says, are bumping into “governance immaturity” the missing pieces that turn AI from a productivity boost into a liability. Think policies, staff learning, data classification and handling, and vendor risk review. Instead of debating whether AI is allowed, Joshua urges leaders to start by accepting the current state and then managing it with intention. As he puts it, “Artificial intelligence is happening and it is happening incredibly fast… the water is coming down the mountain.”

The duo reinforce what many executives have observed: when organizations ban AI, staff still use it they just do it quietly, creating silos and exposure. Joshua connects that to a familiar cybersecurity pattern: shadow IT. People work around constraints to get the job done, especially in a sector that’s under-resourced, remote, and mission-urgent.

The forward-looking takeaway is refreshingly actionable: start with the AI tools already inside your protected environment. If your nonprofit runs on Microsoft 365 or Google Workspace, use Copilot, Gemini, or NotebookLM as your baseline so staff can work with guardrails. For anything outside that ecosystem, require a business case and a review process. Then, build a learning culture where staff share what’s working, what’s failing, and what’s safe.

Joshua also brings urgency from the risk landscape, noting nonprofits are attractive targets because of sensitive data and typically weaker security.

#TheNonprofitShow #NonprofitManagement #AIgovernance

We visit with Kate Berkey, a StoryBrand guide for nonprofits, to talk about something that affects every organization’s bottom line — whether they realize it or not: clear messaging. Or more specifically… what happens when we don’t have it.

Kate opens with a reality check that’s hard to ignore: many nonprofits are unintentionally leaving money on the table simply because their communication is confusing. Not wrong. Not poorly intentioned. Just unclear. And as she shares a phrase that sticks with you, “If you confuse, you lose.”

Using the StoryBrand framework, Kate explains how humans are wired for story, not information overload. The model is simple and familiar: a character wants something, faces a problem, meets a guide, gets a plan, takes action, and moves toward success while avoiding failure. The big shift for nonprofits? Your organization is not the hero — your donor or the person you serve is. Your role is the guide. When that dynamic clicks, messaging becomes more relatable, more actionable, and far more effective in fundraising.

Kate also shines a light on a common nonprofit habit: using big, feel-good language that sounds meaningful internally but leaves outsiders scratching their heads. Phrases like “empowering human flourishing” may feel inspiring in a strategy session, but they create mental work for donors who are just trying to understand what you actually do and how they can help. Clear messaging makes it easy to say yes.

The impact goes beyond fundraising. When your message is tight and repeatable, staff, volunteers, and board members gain confidence. They stop fumbling when someone asks, “So what does your organization do?” and start becoming natural ambassadors in everyday conversations.

Kate wraps with a real-world story of a volunteer event that had heart, energy, and great intentions — but lost momentum because it delivered too much information and ended with multiple calls to action. The result? Confusion instead of commitment. Her fix is beautifully simple: one clear story and one clear ask.

If your organization has ever struggled to explain what you do in a way that sparks action, this conversation is a must-watch.

#Storytelling #NonprofitMarketing #TheNonprofitShow

What does it take for a nonprofit to grow from “we’re getting by” to “we’re building a real engine for impact”? In this energizing conversation, Julia Patrick sits down with Sherry Quam Taylor of Quam Taylor to talk about what nonprofit leaders should truly focus on in 2026 if they want sustainable, strategic revenue growth.

Sherry starts with a bold challenge: stop letting scarcity run the organization. Not as a motivational poster idea, but as a practical leadership decision. Her favorite starting place is a deceptively simple exercise: take the strategic plan and price it out honestly. Not the “squeak by” version. The real version. Reserves. Living wage salaries. The marketing role you never replaced. Staff development. The tech you keep postponing. When leaders finally put the full need on paper, something shifts from fear to possibility, because the organization can now align revenue goals to an actual plan.

From there, Sherry calls out one of the biggest growth blockers in the sector: trying random tactics instead of committing to a planned strategy. As she puts it, “If we align our hours to dollars… there’s actually a math equation that gets to that.” That’s the business of nonprofits in one sentence: staffing, activities, and fundraising effort must match the revenue destination.

Then she brings it home with a refreshing reminder that modern fundraising still wins through relationships. Not stiff, over engineered emails and performative professionalism, but real human connection. Sherry has a simple mantra her clients keep on sticky notes: “Talk like a human.” She explains that both funders and nonprofits want the same thing a genuine conversation with the people behind the work. In a world where messages all start to sound the same, authenticity becomes a competitive advantage.

Finally, she makes a case for something too many organizations avoid: asking for help and budgeting for it. Growth requires investment in expertise, capacity, and support systems, and boards should be champions of that, not roadblocks.

If your nonprofit is ready to fund the plan you actually want, not the one you can barely afford, this episode will leave you with momentum and a smarter path forward.

#TheNonprofitShow #NonprofitManagement #FundraisingStrategy

Nonprofit leaders are staring down a new funding reality and Ben Cooley, CEO of Maxwell and Marie, arrives with the kind of energy that turns anxiety into action. In this conversation, Ben makes the case that “development” is no longer a department it’s a shared posture across the whole organization. When revenue streams shift and donor expectations rise, sustainable growth comes from culture, systems, and a leadership voice that people trust.

Ben draws on his own path scaling a nonprofit from a basement operation to work across 12 countries, with dozens of offices and nearly 1,000 staff. That experience fuels a blunt message for today’s moment: government and institutional funding patterns have changed, high net worth giving is evolving, and donor behavior is more selective than ever. The solution is not panic, it’s diversification and public fundraising strength that can weather storms.

The discussion challenges the way nonprofits talk about donors. Ben and host Julia Patrick point toward a refreshed mindset where supporters increasingly behave like philanthropic investors, expecting clarity, measurable outcomes, and proof of execution. Stories still matter, but numbers and outcomes must become part of everyday language, not just a grant report.

Ben’s rallying call is cultural and operational. “Your resources are in your relationships,” he says, and that means every staff member can contribute to growth. His mantra is simple and powerful: “Everyone needs to be a fundraiser and everyone needs to be a friend raiser.” The conversation also moves into stewardship, where gratitude becomes a strategy, not an afterthought. Ben shares an unforgettable reminder that systems create results, and leadership sets the tone for momentum.

If your organization is wondering how to meet goals in uncertain times, this inspiring convo offers a strong playbook: build rhythms, modernize engagement, prioritize relationship-based growth, and lead with hope that moves people to act.

#TheNonprofitShow #NonprofitFundraising

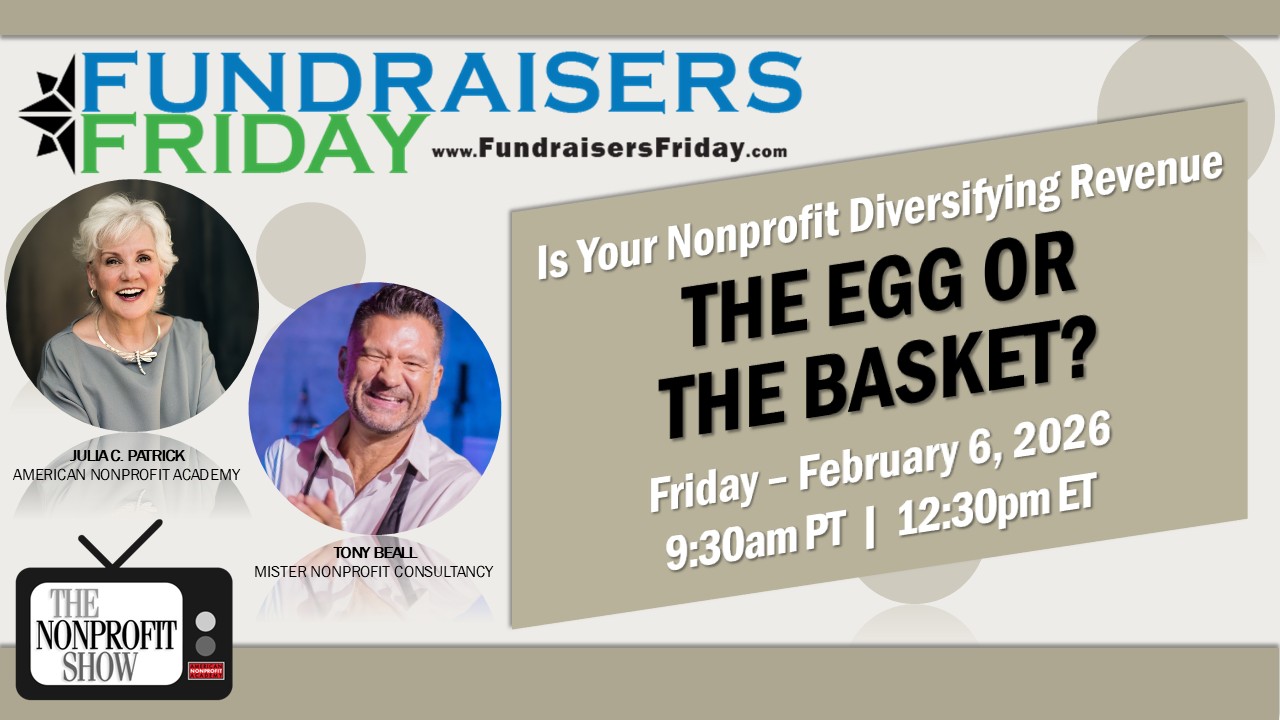

This lively Fundraisers forum delivers real-world guidance on the operational side of fundraising and nonprofit management. Cohosts Julia Patrick and Tony Beall tackle a range of audience-submitted questions that reflect the day-to-day realities facing development professionals and nonprofit leaders.

The conversation opens with a thoughtful discussion about who should pay for professional association memberships, such as AFP. Tony makes a compelling case for organizational investment in staff growth, noting that these memberships provide far more than education. They create peer connection, shared problem-solving, and emotional support in a profession that can often feel isolating. Julia reinforces this with a story from a local chapter event where a fundraiser left feeling renewed and ready to keep going — a reminder that community can directly influence staff retention and performance.

Next, the cohosts address a governance question many nonprofits wrestle with: who sees the strategic plan and fundraising goals? Tony outlines a clear division of roles. Boards and senior leadership help establish the goals, while staff design the strategies to achieve them. Most importantly, these plans should be communicated organization-wide. As Julia puts it, “if people don’t know where the organization is headed, they can’t help move it forward.”

Email communications strategy also gets attention, with insights on sender credibility, leadership visibility, and the technical role email platforms play in engagement rates. Julia shares that American Nonprofit Academy reaches 43,000 subscribers monthly, underscoring how metrics like open rates influence decision-making and timing.

The fast-paced convo also covers the importance of maintaining an up-to-date case statement, describing it as a living fundraising tool that should evolve alongside the strategic plan. Finally, Tony breaks down the distinctions between corporate relations and foundation relations, clarifying differences in funding cycles, expectations, reporting, and relationship management.

#Nonprofitfunding #FundraisingStrategy #TheNonprofitShow

In this energizing conversation, Ann Fellman, Chief Marketing Officer at Bloomerang, provides a data-forward look at what donors will expect in 2026—and what that means for the business of fundraising. The conversation opens with a “hopeful reframe” rooted in fresh research: Bloomerang conducted a national survey of 1,000 U.S.-based donors in November 2025, and the findings point to a bright, measurable shift—not a collapse—in generosity.

Ann’s central message is numbers-backed and morale-boosting: donor behavior is changing, but people still want to give. As she puts it, “It’s not a decline in generosity. It’s a shift in how generosity shows up.” For nonprofit leaders, that shift demands smarter relationship strategy, not louder volume. Younger donors, especially Gen Z and Millennials, are “more relational,” seeking belonging and alignment. Ann expands the classic “time, talent, treasure” framework with two additional drivers—testimony and ties—because social proof and community can be the catalyst that converts interest into giving.

Several statistics land like actionable business insights. Gen Z respondents were twice as likely as Baby Boomers to give after a positive interaction, and 21% said they were influenced by a celebrity or peer. Millennials showed strong values alignment, with 43% prioritizing shared values. Meanwhile, channel strategy needs a reset: donation sites and nonprofit websites remain leading channels, with 48% of Millennials gravitating toward website giving. Yet the surprise data point for 2026 planning is direct mail: Gen Z reported being twice as likely as older generations to give via direct mail—often because tactile outreach can lead to digital conversion through QR codes.

Trust also emerges as a major retention lever. Ann shares that 70% of Americans have done recurring giving, signaling confidence in mission and stewardship, while Gen Z is the most likely generation to stop giving when trust erodes. The operational mandate is clear: personalized, timely, segmented communication that respects attention. In Ann’s words, “Personalization is not a nice to have… it’s going to be a must to have.”

#TheNonprofitShow #NonprofitFundraising #DonorEngagement

Every nonprofit says they want board meetings that are strategic, energizing, and worth everyone’s time. And yet… so many board meetings still feel like a quarterly endurance test: long decks, last-minute prep, and a live meeting that turns into a read-aloud.

We visit with Robert Wolfe, CEO and founder of Zeck—to reimagine how boards and leadership teams communicate—because meeting design is not a “nice-to-have.” It’s a capacity issue. When leaders burn 100–150 hours building decks and board members struggle to engage with clunky PDFs, the mission pays the price.

Robert shares the origin story behind Zeck, built from his experience as an operator who lived the board-meeting grind firsthand. He’s refreshingly blunt about the tools we still tolerate: “No one in the world would wake up in the morning and read their news in a PowerPoint slide deck.” And he makes a bold comparison that lands for any executive team trying to modernize: “Zeck is to board meetings as DocuSign is to signing your contracts and agreements.”

The conversation focuses on what matters for nonprofit business operations: saving staff time, boosting board participation, and moving governance work out of the live meeting and into smarter pre-work. Robert walks through practical innovations like pre-voting (so approvals don’t eat the first 45 minutes), analytics that show engagement (and create healthy peer pressure), and AI features that support content creation—without turning every boardroom comment into a permanent artifact.

If your board meetings create dread, drag down morale, or result in rubber-stamp decisions, this episode offers a modern path forward—one that respects time, improves decision-making, and helps leaders stay focused on outcomes, not formatting.

#TheNonprofitShow #Zeck #BoardGovernance

The Great Wealth Transfer is already in motion, and Gen X is standing in the receiving line! Wendy F. Adams, CFRE, CEO of Cultivate for Good and longtime friend of the show, brings a leader’s lens and a fundraiser’s candor to a question many nonprofits still avoid: Who inherits donor loyalty, and what are we doing to earn it? She shares a personal story that makes the business case impossible to ignore—after her mother passed, Wendy discovered a long list of recurring gifts to multiple organizations. The dollars were real, consistent, and meaningful. The relationship? Nearly invisible.

Wendy introduces a practical concept that flips stewardship into a forward-looking strategy: the “beneficiary checkup.” Instead of waiting until a donor is gone and the organization is forced into an awkward conversation, Wendy challenges nonprofits to invite beneficiaries into the relationship now—while the donor can celebrate impact, and while the next decision-maker can form a real connection.

The episode presses on a tough truth: recurring donors are often treated as “set it and forget it,” and that quiet neglect can become a revenue cliff when a family member inherits the decision. Wendy also speaks directly to Gen X expectations: they want clarity, outcomes, and honesty, not glossy language. As she puts it, “Proof beats poetry.” And when it comes to legacy decisions, she’s blunt: “Give it to us straight and keep us a part of the dialogue.”

For leaders and boards, the call is simple: build confidence around assets, legacy tools, and storytelling that shows what happens because someone invested. The wealth is moving. The question is whether your nonprofit will be part of the next chapter—or quietly left behind.

Nonprofit financial leaders are being asked to do more with less, manage rising risk, and still advance mission with confidence. Dr. Stephanie Rose-Belcher, COO of JMT Consulting, provides a forward-looking conversation on FinTech forecasts and what nonprofit executives must be preparing for now.

Dr. Rose-Belcher reframes finance as the operational backbone of nonprofit leadership, not a barrier. She opens by addressing cybersecurity, urging leaders to view it as a governance, compliance, and financial responsibility rather than an IT task. “This is not an IT issue. This is an everybody issue,” she explains, placing accountability squarely with executive leadership and boards. With donor data, financial systems, and integrated platforms increasingly interconnected, leaders must treat cyber readiness as an enterprise-wide business risk.

From there, the discussion moves to platform strategy. Rather than promoting a one-size-fits-all solution, Dr. Rose-Belcher challenges nonprofit leaders to take ownership of their technology ecosystem. The responsibility, she explains, is not simply to buy tools, but to understand workflows, integrations, return on investment, and the operational change required to realize value. Finance leaders, often serving as what she calls “accidental technologists,” must either develop this fluency or intentionally bring in expert guidance.

Predictive analytics emerges as a defining leadership capability for 2026. Dr. Rose-Belcher encourages nonprofit financial teams to move beyond static annual budgets toward rolling forecasts and scenario planning. By modeling funding shifts, cost changes, and operational risks throughout the year, finance teams can elevate their role from record-keeping to strategic decision support.

Talent constraints also surface as a pressing leadership challenge. With fewer trained accountants entering the field and nonprofit compensation pressures persisting, leaders must focus on skill development, retention, and creative workforce pipelines. Dr. Rose-Belcher shares how JMT is investing in long-term intern programs to strengthen the sector as a whole.

The episode closes with a powerful leadership message: finance teams must act as strategic partners and educators across the organization. “We consider finance the enabler of the mission, not the blocker,” Dr. Rose-Belcher notes—a mindset shift that can transform silos into shared stewardship.

Keith Mestrich, Senior Advisor of Nonprofit and Foundation Partnerships at Crescent Cares, for a great nonprofit business conversation. As nonprofit leaders step into a new year filled with uncertainty and rapid change, Keith offers a clear message: finance isn’t a back-office function to tolerate—it’s one of the strongest tools a nonprofit has to stay steady, make smarter decisions, and keep programs moving when conditions shift.

Keith shares that early in his nonprofit CFO journey, he drew a firm line about how the role should operate: “As the CFO, I’m a full partner, just like any of your other programmatic partners are.” That idea sets the tone for the discussion. When finance is treated as an equal partner—connected to program strategy, staffing, and planning—leaders gain visibility into what’s possible, what’s risky, and what’s sustainable. Keith also explains why finance is often sidelined in the sector: many nonprofit executives rise through program excellence and suddenly inherit budgets, banking, insurance, and reporting—without ever being trained for the business mechanics.

From there, the conversation shifts to technology decisions that can protect both time and dollars. Keith uses a simple example that lands with almost every organization: paper checks. Moving payments and processes into modern systems can increase speed, reduce cost, strengthen tracking, and lower exposure to fraud. He also points to the growing potential of analytical tools and AI to strengthen forecasting—helping leaders anticipate cash-flow pinch points and plan ahead instead of reacting late.

Scenario planning becomes another centerpiece, and Keith keeps it approachable: you don’t have to create a plan for every possible situation. Focus on two major categories—key personnel changes and major financial impacts—and walk through what you would do if something shifted quickly. He emphasizes that this is a management responsibility, while boards should ensure it’s happening and revisited regularly.

Finally, Keith reframes risk management as something that supports confident leadership, not fear. As he puts it, “The bad guys know that our sector isn’t as sharp… They target us.” Reviewing insurance, cyber readiness, and coverage levels isn’t glamorous—but it’s part of protecting the mission with the same care you bring to programs.

#TheNonprofitShow #Nonprofitboards #NonprofitFinance

In the nonprofit world, “funding” is often treated like a finish line. But in this conversation, Gloria Dixon—Executive Director and Director of Philanthropy at the BECU Foundation—frames it as something more useful: a long-term business relationship built on trust, clarity, and shared accountability.

Gloria begins with BECU’s origin story, rooted in cooperative problem-solving: in 1935, Boeing employees pooled money in a tin box so colleagues could buy the tools they needed to work. That same “people helping people” ethos still shapes how BECU shows up today—through products and services, employee volunteerism, and philanthropic partnerships designed to strengthen community financial health.

From there, the discussion moves into what many nonprofits are feeling right now: shifts in funding, rising uncertainty, and the need to adjust strategy without losing momentum. Gloria makes the business case for longer-term, larger-dollar commitments—because multi-year stability gives nonprofits room to plan, staff, and deliver outcomes instead of living in perpetual fundraising churn. She explains trust-based philanthropy as a power shift that respects expertise closest to the work: “We have to trust them to do the work…give them the funding they need… and then just get out their way so they can do the best work.”

That mindset shows up in BECU Foundation’s approach to grants. Instead of long, technical applications, Gloria’s team prioritizes conversation and relationship—practical for a small staff overseeing partnerships with nearly 300 nonprofits annually, and aligned with how trust actually gets built. Reporting expectations, she explains, vary by the size and structure of the partnership—light-touch for small, one-time support, and more defined reporting for multi-year agreements.

Perhaps the most refreshing business lesson is Gloria’s view of “competition.” In her words: “There is no competition, never.” The goal isn’t brand ownership—it’s maximizing community outcomes. BECU also adds value beyond checks: their name can signal credibility to other funders, they share partner insights across philanthropic networks, and they even play matchmaker—connecting senior executives to nonprofit board opportunities when leadership talent is needed.

The Great Wealth Transfer is no longer a future talking point—it is unfolding right now, and nonprofit organizations that are not prepared risk watching history pass them by. Cohosts Julia C. Patrick and Tony Beall confront what may be the most consequential financial shift the nonprofit sector will ever face: an estimated $90–$100 trillion moving between generations, with $12–$18 trillion potentially directed toward charitable causes.

The urgency is unmistakable. While awareness of the wealth transfer exists, Julia and Tony raise a sobering concern: most nonprofits are still treating this moment as business as usual. Traditional planned giving conversations are happening, but without the staffing depth, board expertise, or internal policies needed to responsibly handle what is coming. As Tony notes, “It’s going to happen. It’s the largest transfer of wealth in history, and nonprofit organizations need to think about how they are ready for it right now.”

The conversation exposes a hard reality—many development teams are already stretched thin, juggling events, grants, membership, and major gifts. Expecting those same teams to manage estate gifts, complex assets, and family dynamics without focused expertise is risky. Julia warns that this lack of preparation could result in missed gifts, internal conflict, or worse—board fractures triggered by ethical or values-based disputes over donor sources.

With the kind of energy that makes you sit up straighter: Tim Sarrantonio, now Chair of the Fundraising Effectiveness Project (FEP), leads a boardroom-level conversation about one of the biggest business threats to nonprofits today: misinformation.

Tim pulls back the curtain on what FEP actually is—an ambitious collaboration where major CRM and data partners contribute anonymized giving data that is organized into a secure warehouse overseen by GivingTuesday and the AFP Foundation. The result: monthly, real-world insights into donor behavior at a scale that fundraisers rarely get, and fast enough to influence decisions in real time. For nonprofit leaders trying to forecast revenue, frame strategy, or explain retention trends to a board, this is not “nice-to-know” information—it’s operational intelligence.

From there, the discussion pivots into how misinformation sneaks into our sector: vendor marketing that cherry-picks success stories, “benchmark” claims without context, and social posts engineered for clicks rather than truth. Tim’s advice is blunt and practical: follow the sources, examine methodology, and treat data as a tool for leadership—not a headline to repeat. As he puts it, “All data is the electronic representation of relationships.” That single line reframes retention drops and donor shifts as more than numbers—they’re signals about trust, connection, and experience.

The conversation closes with a future-facing lens on AI. Tim urges nonprofits to treat generative tools like a junior staff member—helpful, fast, and absolutely in need of editing. He even teases a new project: an educational role-playing game for fundraisers that uses AI to interpret workshop artifacts and accelerate learning. The takeaway is clear: in a world full of noise, nonprofits win by becoming disciplined stewards of evidence, context, and credibility.

In 2026, nonprofit finance isn’t just about reporting what happened — it’s about shaping what happens next. Ellie Hume (Regional Director, at Your Part-Time Controller) leasds a forward-facing conversation on financial leadership that starts with one powerful idea: your organization’s strongest advantage is what you choose to control.

If your nonprofit is ready to “spiral up,” this episode offers a finance-and-management playbook that turns mindset into momentum—so you can stay steady, stay strategic, and stay fundable.

Ellie reframes today’s uncertainty—funding volatility, staffing pressure, new compliance expectations—as a call to build resilience through intentional decisions. She challenges leaders to stop relying on “SALI” (Same As Last Year) and instead strengthen revenue diversification: monthly giving programs, new grant relationships, and smarter prospecting that expands beyond familiar funders.

From the finance seat, Ellie makes scenario analysis feel practical and doable. Build multiple budget versions, monitor what’s changing, and be ready to adjust the levers as reality shifts. Financial data becomes fuel for action when it’s used for forecasting and decision-making—not just for looking in the rearview mirror.

The conversation also brings AI down to earth. AI isn’t “coming someday”—it’s already embedded in accounting systems and donor databases. Ellie talks about adopting tools with purpose, using them to reduce administrative drag, increase speed, and free staff to focus on higher-value work. As Ellie puts it: “Control what you can control, and that is your mind and the actions that result from what you want to do.”

Finally, Ellie connects governance, compliance, and cybersecurity to financial stewardship. Cyber risk and fraud are rising, and boards have fiduciary responsibility to protect organizational assets. That means budgeting for safeguards, setting internal guardrails for AI use, and even seeking funding specifically for infrastructure that protects mission delivery.

Why don’t nonprofit boards do their work — and what can executive leaders actually do about it? In this episode we welcome back executive coach, author, and speaker Hardy Smith, creator of the Amazon bestseller Stop the Nonprofit Board Blame Game. Hardy tackles the question nonprofit leaders lose sleep over: when boards underperform, is the problem really “the board”… or the way we build the board?

Hardy makes a bold case that disengagement often starts long before the first meeting — in recruitment that’s rushed, vague, and driven by panic. Too many organizations wait until seats are empty and the annual meeting is looming, then scramble to fill slots with “busy, well-known names” without real vetting or alignment. The result? Board members who cannot prioritize your mission, and leaders frustrated that nothing changes.

From there, Hardy goes straight to the business mechanics of governance: expectations, clarity, and accountability. If fundraising is part of board service, say it early. If meeting attendance matters, define it. If board members are being recruited for their influence, then design roles that actually use their influence. Hardy warns that when organizations avoid the “money talk” out of fear, they create a trust gap that’s hard to repair: “That’s called bait and switch. And it’s illegal.”

Most importantly, Hardy explains what makes great board members shut down: a board experience that wastes time. His prescription is practical and board-chair-ready—make meetings matter by structuring them around strategic progress, decision-making, and real conversation, not passive report approval. And if you want board ownership, involve them in the plan from the beginning—because as Hardy reminds us, “If they help bake the cake, they own the cake.”

Ready to stop blaming and start building a board that performs? This episode gives you a playbook to recruit with purpose, set expectations with confidence, and design meetings that earn engagement.